It was late in the day when Max (not real name) called me for a second opinion on his troubles with TDS. He’s planning to travel to the US in near future and needs his Income Tax return acknowledgment for the last 3 years. His routine CA told him a big amount to be paid as tax and hence this call to check on it.

Max was working in a media advertising company which went bankrupt in Dec 2017 and has shut down filing insolvency. The finance department of the company was deducting TDS from his salary, but now his CA checked Form 26AS and told him that none of that amount has reached the Tax wallet. I asked him why he didn’t raise this issue with the insolvency professional during the shutdown process. He remembered that there was an option to raise such issues, but he was never aware of the fact that TDS deducted was not deposited to Government. He wanted to know “What can be done now?”

TDS (Tax Deduction at Source) helps the salaried persons in paying tax in easy installments and avoids the burden of a lump sum payment. Same time, it helpsGovernment with funds for operations.

Why do employers deduct TDS?

As per section 192 (1) of Income Tax Act 1961, employers are supposed to deduct tax before paying salary to the employees, which shall be computed as per the income of the employee (all sources and investments as per employee declaration) and the rate applicable for the financial year. Computation of tax must be done in accordance with the income tax rules prevalent in the respective financial year (most of the central government budgets will have multiple changes in the rules).

Employers compute tax based on the income, investment, expense proofs or previous employee earnings submitted by employees. Normally a declaration is taken fromemployee at the beginning of the financial year (around April in India) and the same is verified towards the end of the financial year (normally around Jan)

What are employers supposed to do with the deducted TDS amount?

Employers do two things once TDS is deducted – 1) Remit TDS to Central Government monthly, 2) File TDS Returns (statement of deduction of tax u/s 192 in Form 24Q) quarterly

As per Rule 30, 31 of Income Tax Act 1961, Employers are supposed to remit the TDS amount every month to Central Government before the 7th day of the next month. At the end of the financial year, time till next month end (i.e., 30th April) is allowed for remitting TDS amount. TDS remittance is done as e-payment (via NSDL) to Central Government against the TAN of the employer.

After every financial quarter, the employer has to file TDS returns by the end of next month. For example, TDS returns of the TDS amount remitted in Oct, Nov, Dec will have to be filed before 31st Jan. TDS returns also detail the PAN of the employees on whose behalf the tax is paid.

In case of default of TDS payment, following are the consequences:

- Disallowance of 30% of expenditure, other than salary – Section 40(a)(

ia ). E.g., that expense, other than salary, cannot be shown in P&L - Levy of interest – Section 201

- Levy of penalty – Section 271C

- Prosecution

Tax deduction Account Number (TAN) is the unique 10 digit alphanumeric identifier issued by the IT department, for all such persons who are responsible to deduct TDS.

What can employees do proactively?

Following are the things to be taken care from employee perspective:

- Provide Investment Declaration accurately to your company’s HR/Accounts/Finance department

- Maintain proof of TDS deduction including salary slips, bank statements

and any other documents as evidence that TDS has been deducted. - Ensure with your employer that TDS has been deducted against your correct PAN. It could happen that you may have provided your employer with an incorrect

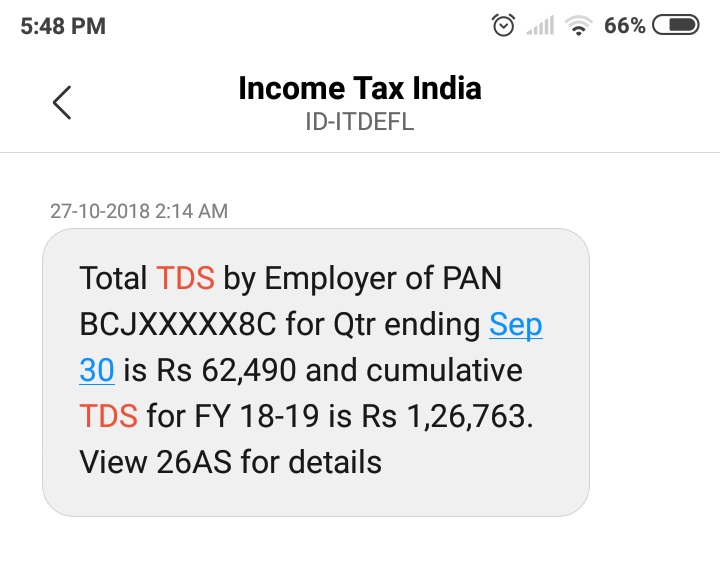

PAN . In that case, request your employer to revise the same. - Check Form 26AS to ensure TDS deducted from your salary has reached government (Note this can be checked only after your company files TDS returns, i.e., one month after financial quarter. Returns take almost ten days to reflect against your PAN)

- Update your mobile number and email id in the Income Tax login, as

IT department provides SMS alerts for TDS credits to your PAN

Form 26AS is a statement issued on behalf ofIncome Tax department. The details of tax indicated are based on the data submitted by the deductor (employer) and confirmation from the bank that tax has been received.Check your tax credit by viewing Form 26AS from eFiling account at http://www.incometaxindiaefiling.gov.in (Login to your account using PAN)

What if employee finds a default from the employer?

The first thing employee should do is bring it to the notice of his employer and request him to do the needful, before the deadline. If in spite of repeated reminders and complaints, the employer does not address the issue, the employee has the right to approach the tax authorities.

The income tax department has stated through circulars issued recently that in case of failure to deposit tax that has been deducted, demand to pay must not be made on the taxpayer. It further states that the tax dues must be recovered from the employer instead. So by all probability,

If your employer fails to take action regarding this, you can alert the tax department by making a complaint in writing to your assessing officer

Find details of your assessing officer at Income Tax Site

What can Max do now?

In this case, the employer was bankrupt and Max had the opportunity to rightly claim this during Insolvency procedures. He can check the

Since the company has dissolved, it will be difficult to go for litigation against the department to prove his innocence. Since no timely action was taken by Max, he’ll need to pay taxes from his own money as the salary is a source of income that he need to pay tax, especially considering that its required for his visa purpose.

Although it is the employer’s duty to remit the deducted tax to the government, you must ensure there is no pending liability in your name. Follow options provided by the Income Tax department, in case of non-compliance by the employer or deductor.